A growth strategy is a plan that increases your company’s revenue, market share or customer acquisition. It involves internal alignment and often requires significant investment in tactics like product development or marketing campaigns.

One common growth strategy is increasing your business’s market share through lower prices, according to small business experts. Another is to increase repeat sales through targeted campaigns such as discounts or loyalty programs.

Product Development

A company’s growth strategy should align with its goals, resources and market conditions. While the specific strategies that a company implements will vary, the overall goal should be to achieve sustainable long-term growth.

Internal growth strategies rely on the company’s own products and market to drive growth. The type of internal growth strategies a business implements will depend on its industry and specific needs, but could include things like developing new product lines or expanding existing product features.

The process of determining the best product development strategy for your company can be informed by conducting extensive consumer research, including interviews and surveys, to understand what your customers want and need. It also helps to identify pain points that are big enough to warrant a product-based solution.

For example, Dropbox’s viral loop strategy tapped into users’ need to backup their files and data. Users were offered an incentive to share the Dropbox service with their friends — which increased the number of new users and boosted revenue streams without requiring a huge initial investment.

External growth strategies, on the other hand, rely on resources outside the company to help it grow. These might include partnering with a marketing agency to optimize a company’s online presence or building a referral network. It could even be as simple as partnering with a new supplier to offer a product that sets the business apart from its competition.

Market Penetration

Market penetration is a marketing strategy that aims to increase a company’s overall market share in its current markets. This is done by lowering prices of products and services and targeting consumers who would otherwise be buying from a competitor. This is a risky strategy, however, as a company that lowers its prices may lose customers to competitors who offer similar products at cheaper prices.

Regardless of what market penetration strategy is chosen, companies need to ensure that their marketing and product development teams are working as one cohesive unit. This is crucial for creating a sustainable business that is able to adapt to the market as it changes.

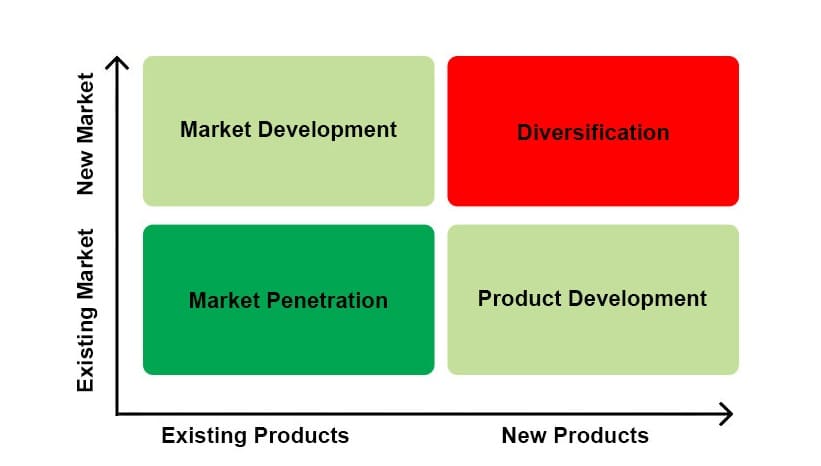

The four major growth strategies are: product development, diversification, market penetration and acquisition. Each has its own unique set of challenges and risks, but it is important to recognize that each offers a different path to growth for your business. Using the Ansoff Matrix as a framework can help you evaluate your company’s current position and determine which path is best for it. Regardless of which strategy is chosen, it is crucial to regularly evaluate its performance and make gradual adjustments as needed. By doing this, you can continue to grow your business and reach your goals. To learn more about growth strategies, book a call with us today.

Diversification

Diversification is an approach to growth that involves a company creating and selling new products or services to different customer markets. This strategy can be risky and requires significant research, but it also has the potential for a high payoff.

One of the most well-known examples of a successful diversification strategy is Dropbox’s “Viral Loop” campaign in 2008 and 2009. At the time, people were hesitant to use cloud storage for their files because they didn’t trust it. To overcome this obstacle, Dropbox offered a discount to anyone who recommended their product to a friend. This created a chain reaction that helped grow the Dropbox user base exponentially.

Businesses can also implement this strategy through forward acquisitions, where they purchase companies in the target market or industry and rebrand them with their own name. This can help companies increase revenue quickly while eliminating competition and gaining access to established customer bases.

Another way to diversify is by investing in a diverse portfolio of assets. This includes equities, bonds, and cash deposits. However, it’s important to remember that all investments have a certain amount of volatility. That’s why it’s important to be diversified by holding a mix of asset classes, as well as taking into account your own financial goals and risk tolerance when creating an investment portfolio.

Strategic Alliances

Strategic alliances bring together companies with complementary products and resources. The aim is to pool the resources of each partner to increase the overall size of the venture and gain a greater market share. The partners may also share their brands, technical knowledge or distribution channels in order to reduce costs and speed up the development of a new product.

The advantages of an alliance include access to a new market, increased public perception and the ability to exploit synergies. However, it is important to identify the real reasons for forming an alliance and to carefully monitor the results to ensure that the goals are being achieved.

An alliance can come to a natural end when the original objectives have been achieved or no longer serve the interests of the involved enterprises. For example, the partnership between Dassault and British Aerospace was founded to manufacture the Jaguar fighter jet and once the program was completed the cooperation ended.

In contrast to natural ends, strategic alliances can also come to a premature end when the partners’ market shares diverge or the stronger partner takes over the weaker one. This is a common trend in fast-growing industries and can significantly erode the value of the initial contributions of the weaker company. Two types of strategic alliances are most often found in this situation: collisions between competitors and alliances of the weak. Both of these tend to fail, although they can be avoided by creating a partnership between strong and weak companies that is based on mutually beneficial contributions from the outset.